Many parents start planning for college as soon as the baby arrives. Some look to 529 Plans (named after the IRS code section that defines it). It is always best to take a closer look.

A 529 plan is a tax-free savings program designed to cover “qualified” college expenses. Beneficiaries can be changed–with important limitations–if the initial beneficiary does not use the funds.

Qualified expenses include tuition, fees, supplies, books, equipment, and room and board, for students enrolled at least half-time. The expense for room and board are limited to the greater of the actual amount charged by the school for living on campus, or the allowance as determined by the school in it estimated cost of attendance used for financial aid purposes.

Changing beneficiaries is subject to certain rules. The alternative beneficiary must be related to the original beneficiary. This relationship includes children, parents, and in-laws of the original beneficiary. Spouses are not included.

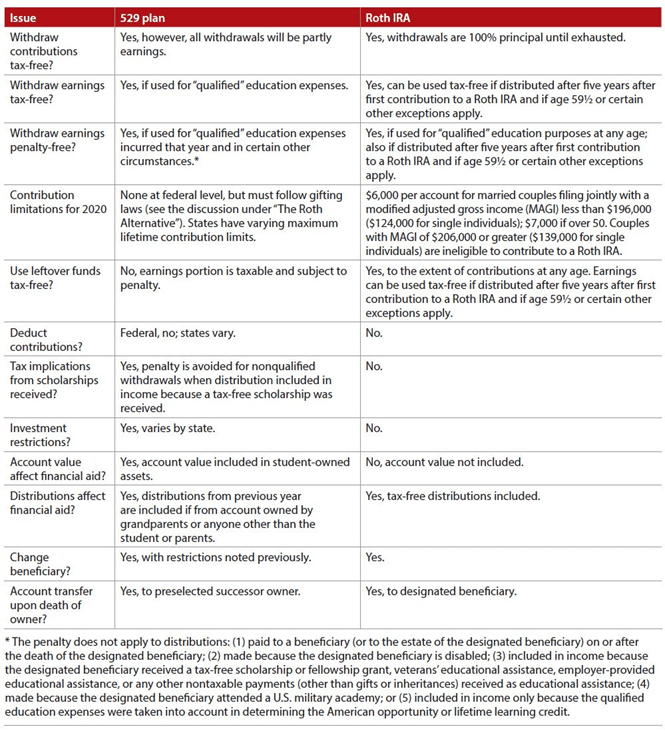

As shown in the table below, 529 plans’ primary advantage over Roth IRAs is using the earnings before age 59 ½. However, if the contributions stay in the Roth account for 5 years, parents can withdraw the contributions before age 59 ½ without incurring a penalty. Since most parents start saving for their children’s education early in the child’s life, meeting this 5-year qualification should not be a problem.

There are also no annual limitations on how much can be contributed to a 529 Plan, other than gift tax considerations. Because the contribution to a 529 Plan is considered a gift for tax purpose, the best strategy would be to limit the contribution to $15,000 (or $30,000 for a married couple). Individuals and couples need to consider if the Roth limitation (currently $6,000/year per person unless they are over 50 then the limitation is $7,000) is worth the trade-off.

Changing beneficiaries in a Roth IRA appears to be much easier with a Roth as opposed to a 529 Plan.

State income tax issues could arise when taking unqualified withdrawals. See savingforcollege.com for information regarding states with income taxes and any state-imposed restrictions.

In summary, individuals with higher incomes should consider a 529 Plan because incomes above a certain level cannot contribute to a Roth IRA. However, many taxpayers for whom college costs are a real worry should consider using a Roth IRA.

The most important drawback of a 529 Plan is if the child decides not to attend a college or vocational school or when there is money left over in the 529 Plan. Changing beneficiaries in a 529 Plan is difficult and there is a lot of paperwork. An additional consideration would be if the child receives scholarships and grants. Should the child’s hard work be rewarded by passing the 529 funds to their brother or sister? The best way to make the decision of whether to invest in a 529 Plan or a Roth IRA is to carefully assess the pros and cons to maximize options for an uncertain future.

Excerpted from the Journal of Accountancy, “Look before you leap into a 529 Plan”, June 2020.

Ready to Take the Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend a seminar.